1. What is FundedX.com?

FundedX.com is primarily known as a prop trading firm, offering funded accounts to traders who successfully pass their evaluation processes. Prop trading firms like FundedX provide capital to skilled traders in exchange for a share of the profits. This model allows traders to access significant capital without risking their own money, making it an attractive choice for many.

FundedX sets itself apart with its trader-centric policies, flexible evaluation structures, and competitive profit splits. The platform aims to empower traders by providing the resources they need to thrive in the financial markets.

2. Key Features of FundedX.com

a. Flexible Evaluation Programs

FundedX.com offers multiple evaluation programs tailored to different trading styles and levels of experience. These programs typically include:

- Single-phase evaluations

- Multi-phase evaluations

- No-evaluation instant funding options

Each program comes with specific trading conditions, allowing traders to select the one that best matches their expertise and risk tolerance.

b. Competitive Profit Splits

One of FundedX’s standout features is its generous profit split structure. Most traders can retain up to 80% of their profits, with some plans even going as high as 90%.

c. Wide Range of Tradable Assets

FundedX provides access to various markets, including:

- Forex

- Stocks

- Commodities

- Cryptocurrencies

- Indices

This diversity ensures that traders can explore and capitalize on opportunities across different asset classes.

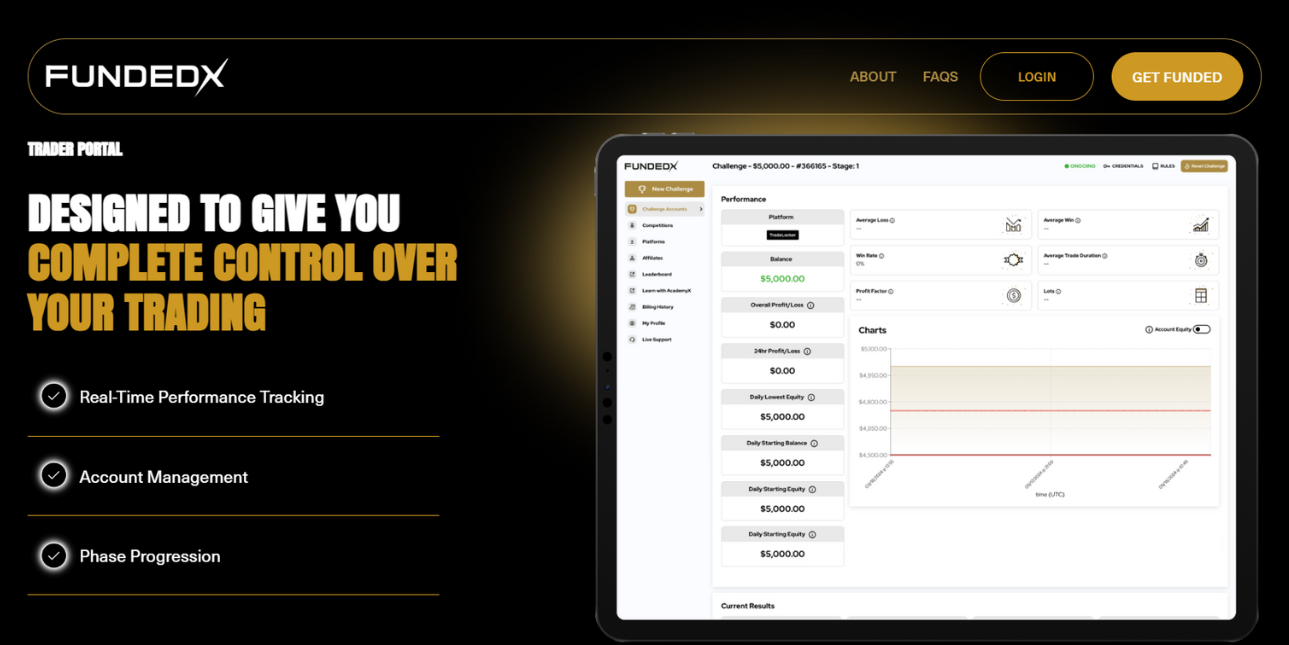

d. User-Friendly Trading Platforms

The platform supports popular trading software like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their robust charting tools, technical analysis features, and reliability.

e. Transparent Rules and Guidelines

FundedX maintains clear and transparent rules regarding drawdowns, leverage, and trading styles. Traders can employ scalping, swing trading, or algorithmic strategies without fear of hidden restrictions.

f. Educational Resources

The platform also offers a wealth of educational resources, including webinars, trading tutorials, and market analysis. These tools are beneficial for both beginners and experienced traders.

3. How Does the Evaluation Process Work?

The evaluation process at FundedX is designed to assess a trader’s ability to manage risk and generate consistent profits. Here’s an overview:

Step 1: Select an Evaluation Plan

Traders choose a plan based on their preferred account size and trading objectives.

Step 2: Meet the Profit Target

To qualify for a funded account, traders must meet specific profit targets within a set timeframe. For example, an account may require a 10% profit target over 30 days.

Step 3: Maintain Risk Parameters

Traders must adhere to risk management guidelines, such as daily drawdown limits and overall account drawdown thresholds.

Step 4: Verification Phase

For multi-phase evaluations, a second phase may be required to confirm the trader’s consistency and risk management skills.

Step 5: Receive Funding

Once the evaluation is successfully completed, traders are granted access to a live funded account.

4. Pros of FundedX.com

a. Low Financial Risk

Traders can access significant capital without risking their own money, reducing the financial barriers to entry.

b. High Profit Potential

With profit splits of up to 90%, traders can maximize their earnings.

c. Flexible Trading Rules

FundedX’s flexibility in trading styles and strategies makes it suitable for various trading approaches.

d. Diverse Market Access

The availability of multiple asset classes ensures traders can diversify their strategies.

e. Responsive Customer Support

The platform’s customer support team is available to assist with queries, providing timely and helpful responses.

5. Cons of FundedX.com

a. Evaluation Fees

While the evaluation fees are competitive, they may still be a barrier for some traders.

b. Strict Drawdown Limits

Traders must adhere to strict drawdown limits, which can be challenging for those with high-risk strategies.

c. Limited Instant Funding Options

While instant funding is available, it’s not as comprehensive as some competitors’ offerings.

d. Learning Curve

Beginners may find the evaluation process and trading rules overwhelming at first.

6. Pricing and Plans

FundedX.com offers a variety of pricing plans depending on the account size and evaluation type. Typical plans include:

- Starter Plan: $150 for a $10,000 evaluation account

- Pro Plan: $300 for a $50,000 evaluation account

- Elite Plan: $600 for a $100,000 evaluation account

These fees cover the cost of accessing the evaluation process and trading platform features.

7. User Experience

a. Platform Usability

The FundedX website is clean, intuitive, and easy to navigate. Key information about plans, evaluations, and policies is readily available.

b. Trading Experience

Integration with MT4 and MT5 ensures a seamless trading experience. Execution speeds are fast, and the servers are reliable.

c. Mobile Accessibility

FundedX offers mobile-compatible platforms, allowing traders to manage their accounts and execute trades on the go.

8. Comparison with Competitors

When compared to other prop trading firms like FTMO, MyForexFunds, and TopStep, FundedX holds its own with competitive pricing, high profit splits, and flexible evaluation options. However, it lacks some of the advanced features and instant funding options offered by a few competitors.

9. Is FundedX.com Legitimate?

FundedX is a legitimate platform with a growing reputation in the trading community. The company’s transparency, customer support, and positive user reviews reinforce its credibility.

10. Conclusion: Is FundedX.com Worth It?

FundedX.com is an excellent choice for traders looking to access significant trading capital without risking their own money. The platform’s flexible evaluation processes, competitive profit splits, and user-friendly trading tools make it appealing to a wide range of traders.

While the strict drawdown limits and evaluation fees may pose challenges, the potential rewards outweigh the risks for skilled traders. Whether you’re a day trader, swing trader, or algo-trader, FundedX provides the resources and support needed to succeed in the financial markets.